Verification Guidelines

Verification

Each year, the Department of Education selects certain FAFSA applications for a process called ‘verification.’ The law requires colleges to obtain information from the family to verify the accuracy of the information reported on the FAFSA (e.g., income, family size, benefits, educational level). Crafton Hills College verifies every file identified by the federal government as part of this process, using worksheets based on federal regulations and guidelines. Beyond those applications selected for federal verification, the law requires colleges to request further documentation when a FAFSA application and subsequent paperwork appears incomplete, conflicting information is discovered, or additional information is needed to complete the application processing.

The Financial Aid Office must identify and resolve any discrepancies in information received with respect to a student's application for Title IV aid. These items include, but are not limited to:

- Student aid applications

- Need analysis documents (e.g., Institutional Student Information Records (ISIRs) and Student Aid Reports (SAR)

- Federal income tax return transcripts and Wage and Income Transcript

- Documents and information related to a student's citizenship.

- School credentials (e.g., high school diploma)

- Documentation of the student's Social Security Number (SSN)

- Unusual Enrollment History (UEH), when students have received federal funds at three or more schools in the last three years.

A student is not eligible to receive federal, state, and/or institutional need-based aid until all required paperwork has been submitted and processed.

Verification Deadlines for 2024-2025

The key application deadline, regulated by the U.S. Department of Education, will be followed at Crafton Hills College and can be located in the Department of Education Verification Guide.

If you are selected for verification, either by the federal processor or by the Crafton Hills College Office of Financial Aid, students will be notified via CHC student email of the documents that must be submitted to complete verification.

All financial aid notifications are sent to the CHC student email account.

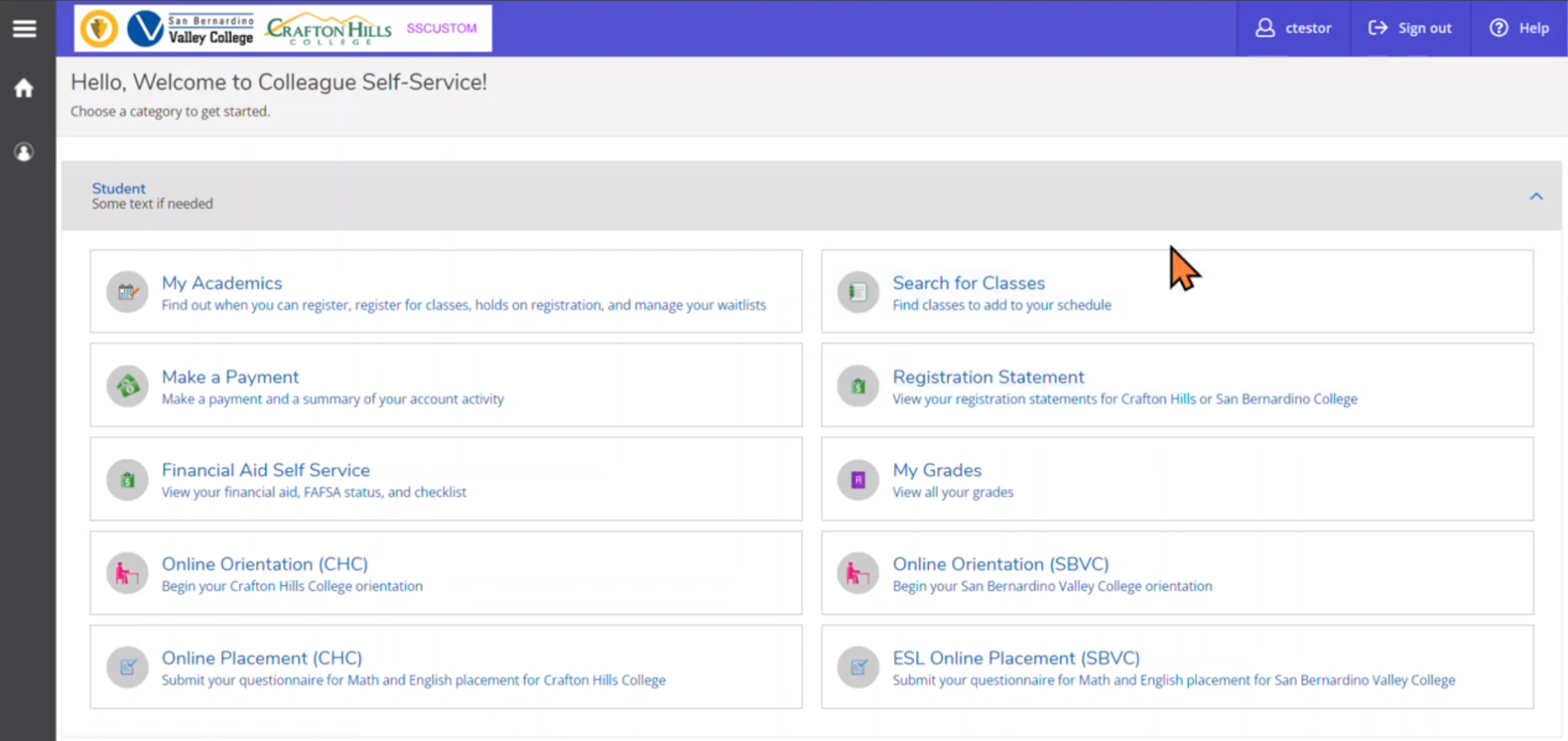

Your submitted documents will be reviewed. We may complete your financial aid award or request additional documents depending on the documentation provided. The information on your FAFSA will either be confirmed or corrected by the financial aid office. You can continue to check the status of your documents by going to your Financial Aid Self-Service via Web Advisor or check your CHC student email periodically for updates.

The review process could take 2-4 weeks, depending on the time of year and the volume of applications. You will be notified by email after the verification process is complete and a financial aid award has been made available to view in the Financial Aid Self-Service via Web Advisor.

Corrections

If discrepancies are found between the documents submitted for verification and the information on the SAR or ISIR, the following procedures will be used to make the corrections:

- SAR – Corrections to income or asset figures, household size, and dependency will be made by Crafton Hills College to obtain an accurate need analysis of your financial aid application information. If corrections are needed, the data will be sent to the Central Processor to produce an updated electronic Student Aid Report (SAR).

- Award changes – If corrections to the SAR due to verification result in a change in the student’s award, the student will be sent a revised Award notification by CHC student email. Financial aid notifications are produced daily for new awards and changes to awards.

Dependency Status

Students who wish to request a change in dependency status are required to submit a Dependency Override Packet, which must include a personal statement clarifying the rationale for their request and/or a letter from three (3) third-party professional (e.g., pastor, counselor, teacher, caseworker, etc.) and any other supporting documentation, such as court orders, police reports, etc. None of the conditions listed below qualify as unusual circumstances meriting a dependency override:

- Parents refuse to contribute to the student’s education.

- Parents are unwilling to provide information on the FAFSA or for verification.

- Parents do not claim the student as a dependent for income tax purposes.

- Student demonstrates total self-sufficiency.

Decisions to exercise professional judgment or a dependency override will be on a case-by-case basis, and decisions regarding requests for adjustment are final and cannot be appealed. All overrides do not carry over from year to year. It is a student’s responsibility to provide sufficient documentation to prove their unusual circumstances.

Despite the possible expectation of a parent's contribution for an independent student, the aid administrator cannot shift a student from independent to dependent status for federal purposes if the student otherwise meets the requirements of the federal definition of an independent student.

Federal regulations consider you a dependent student for financial aid purposes unless you meet one of the following criteria (An independent student may be required to verify their status by filling out specific documents related to the specific application item that makes the student independent):

- You were born before January 1, 2001

- You were married on or before the date you completed the FAFSA or CADAA

- You will be working on a master’s or doctorate program (such as an MA, MBA, MD, JD, or Ph.D., etc.) at the beginning of the 2024-2025 school year

- You are currently serving on active duty in the U.S. Armed Forces for purposes other than training

- You are a veteran of the U.S. Armed Forces

- You have or will have children who will receive more than half of their support from you between July 1, 2024, and June 30, 2025

- You have dependents (other than your children and spouse) who live with you and who will receive more than half of their support from you between July 1, 2024 and June 30, 2025

- At any time since you turned 13, both your parents were deceased, you were in foster care, or were a dependent/ward of the court.

- You are/were an emancipated minor as determined by a court in your legal state of residence.

- You are/were in legal guardianship as determined by a court when you reached the age of majority in your legal state of residence.

- On or after July 1, 2024, your high school or school district homeless liaison determined

that you were an unaccompanied youth who was homeless or was self-supporting and at

risk of being homeless. Unaccompanied youth who are/were homeless are defined as:

- 21 years of age or younger or still enrolled in high school as of the day you sign the FAFSA application.

- not living in the physical custody of a parent or guardian, or

- lacking fixed, regular, and adequate housing

- On or after July 1, 2024, the director of an emergency shelter or transitional housing program funded by the U.S. Department of Housing and Urban Development determined that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless.

Verification of Household Size

- Parent remarriage after applying

- If the applicant is a dependent student and his parent remarries between the application and the verification process, the household size must include the new stepparent.

- Other adult legal dependents (other than spouse and children)

- Other adult persons who live with the student and/or parents of a dependent student and receive more than 50% or more of their support from the student or dependent student’s parent as of the FAFSA or CA Dream Act signing date and will continue to do so for the academic year must submit documentation to verify this in order to be included in the household size.

Verification of Income

All students selected for verification must verify their income by providing the correct document from the IRS.

- If the student or parent filed taxes, they must submit a copy of their tax transcripts and/or parents’ tax transcripts (if the IRS Data Retrieval was not used). If a student or parent was required to file taxes and did not, verification cannot proceed until the student or parent submits a tax transcript or use the IRS Data Retrieval on the FAFSA (if available). The IRS Data Retrieval is not available on the CA Dream Act Application.

-

If the student and their spouse or parents of a dependent student are separated or divorced but filed a joint tax return, W-2 forms are required to determine the amount of income and taxes paid for the student or the custodial parent of a dependent student. (Custodial parent refers to the parent who had custody of the student or who the student last lived with.) In the case of stepparents, both incomes will be used in the calculation.

-

If the student’s parent(s) filed an amended 2022 IRS tax return, the parents must provide both a 2022 IRS Tax Transcript and a signed and stamped by the IRS copy of the 2022 IRS Form 1040X “Amended US Individual Tax Return that was filed with the IRS.

-

If an individual has been granted a filing extension by the IRS, provide the following documents: A copy of the IRS Form 4868, “Application for automatic Extension of Time to file US Individual Tax Return, and copy of IRS Form W-2 for each source of employment received for the tax year 2022 and if self-employed, a signed statement certifying the amount of the individuals AGI and US Income tax paid for tax year 2022.

-

A victim of IRS identity theft who has been unable to obtain a 2022 IRS Tax Return Transcript or use the IRS DRT must provide a signed copy of the 2022 paper IRS income tax return that was filed with the IRS and a signed copy of IRS Form 14039 “Identity Theft Affidavit” if one was submitted to the IRS. If a copy of Form 14039 was not retained or the IRS did not require you to submit one, the student or parent (if dependent) may provide one of the following:

-

A statement signed and dated explaining he/she was a victim of IRS identity theft, and that the IRS is investigating the matter. The statement must also indicate that the individual submitted Form 14039 to the IRS but did not keep a copy or that he/she was not required to file the form: or

-

A copy of a police report if it was filed related to the IRS identity theft.

-

Subsequent ISIR transaction

If the Financial Aid Office receives another ISIR transaction after the student’s file has already been awarded, the new ISIR transaction must be verified. Any changes to data elements that result in a change in EFC must be verified by requesting additional documentation and placing a hold on the financial aid disbursement until resolved.